LTV:CAC ratio: is it a relevant metric for your brand?

January 5, 2023

Ratio LTV:CAC : A key indicator in eCommerce and Saas

LTV:CAC Ratio is a primary indicator of your brand’s profitability, growth potential, and the overall health of your business. In other words, LTV:CAC ratio is a must-track metric.

The LTV (Customer Lifetime Value) : how much money a customer brings to your startup

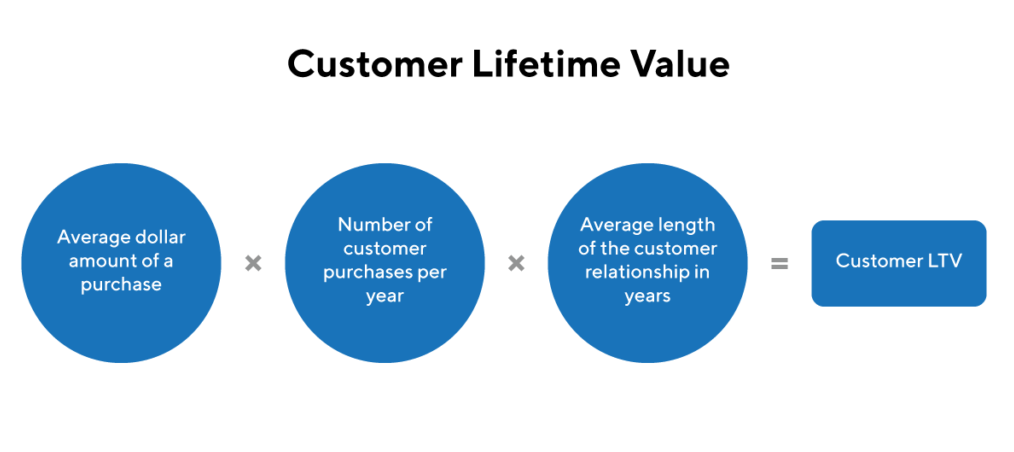

Customer lifetime value (CLV) is a prediction of the total amount of money that a customer will spend on a company’s products or services over the course of their relationship with the company. It is a key metric for businesses because it allows them to determine the profitability of their customer relationships and to allocate resources appropriately.

Calculating, monitoring, and optimizing your LTV:CAC ratio is critical to your brand’s success because it indicates how effective your marketing efforts are, and it projects your brand’s long-term profitability.

LTV:CAC Ratio: how much money your business makes

The LTV/CAC (lifetime value to customer acquisition cost) ratio is a financial metric that compares the lifetime value (LTV) of a customer to the cost of acquiring that customer (CAC). we use it to measure the efficiency and effectiveness of a company’s customer acquisition efforts. it can help businesses understand whether they are generating a positive return on investment (ROI) from their marketing and sales activities.

What is a good LTV:CAC Ratio?

LTV:CAC Ratio depends on both indicators the CAC (Customer Acquisition Cost) (lien vers notre article précédent CAC) and the LTV, ie comparing the effort required to acquired a new customer vs the revenue a new customer generates.

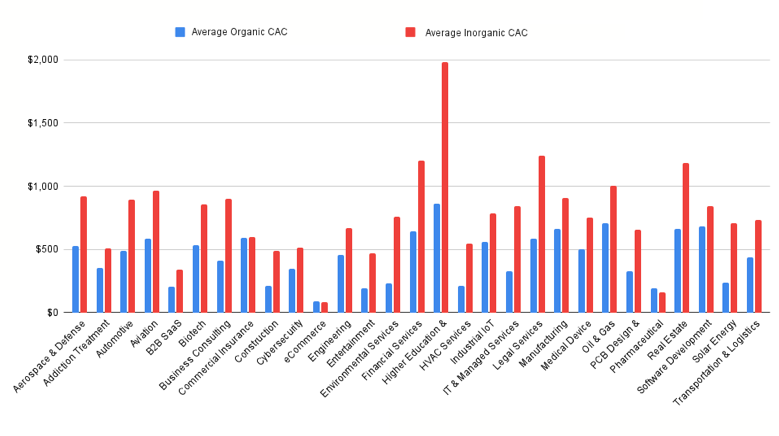

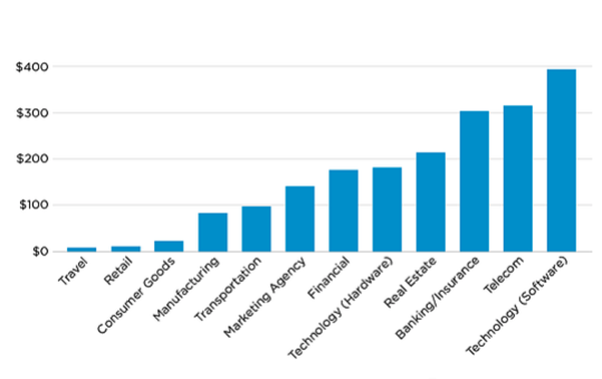

Once you have computed your CAC, you need to know how your company is positioned in the market. For this purpose, some benchmarks exist online. For example, these articles provide 2 diagrams comparing CAC by industries::

Source : Fisrt Page Sage

Source : demandjump

As you can see, there is an inconsistency in the value of the CAC by industry, depending on the sources. For example, the CAC in Fintech is estimated between $180 and $1200. This could be confusing to position the business against the competitors.

LTV will also differ regarding the other competitors. Therefore, it is necessary to compare the CAC with the LTV of the business.

Ideally, LTV:CAC ratio should be at least 3:1 ,which means you should make 3x of what you would spend in acquiring customers. If your LTV:CAC is less than 3, it’s your business sending out a smoke signal! It’s an indicator to try and reduce your marketing expenses.

A business with a too low or high LTV/CAC Ratio is a bad signal

Definitely, if the LTV:CAC ratio 1:1 means that you are losing money and you need to pivot the business model.

In case the LTV:CAC ratio is too high, according to Userpilot , it implies that marketing efforts should be increased. You might naturally think that the higher the rate, the more profitable the business model. However, with additional marketing efforts, the sales volume could be even higher.

LTV:CAC ratio varies during the life of the company

CAC also depends on the development stage of the company.

When the company is at the seed stage, launching a new solution, CEOs and cofounders spend more time in marketing and sales. However, their costs are not always included in the CAC estimation.

Especially when the founding team doesn’t pay themselves, their time is not translated in monetary valuation, and therefore excluded from the P&L accounts. In this case, they underestimate CAC.

Efforts to get traction at the early stage are higher than at a later stage when the reputation of the company is established. But marketing expenses may not represent reality.

Analyzing profitability only based on CAC, LTV and the LTV:CAC ratio is a reducing approach. It should take into account other factors and parameters like CAPEX to estimate if a business is worth investing in.

****

Need to get feedback for your business plan? Submit your pitchdeck to our team

Do have a specific question about your startup? Consult our experts

Visit IdeasFundX: a new tool to increase the chances to raise funds and to improve the efficiency of the investment process for companies and investors .