Is there a gender bias when female founders are fundraising?

May 16, 2019

Are venture capitalists still biased toward men?

It’s not easy for women to get funding from venture capitalists as men do. Even though women have been calling for gender equality for a long time, sexism still exists in various fields. Entrepreneurship is not an exception.

According to a report by Fortune magazine entitled “Female Founders Got 2% of Venture Capital Dollars in 2017, venture capitalists invested $1.9 billion in all-women teams in 2017, which only takes up 2.2% of 2017’s total investments. In contrast, all-men teams got $66.9 billion—roughly 79% of 2017 investments. As for the number of deals, in 2017, women-founded companies merely accomplished 4.4% of all VC deals.

Additionally, the average deal size for women-led companies in 2017 was just over $5 million. For men-led companies, the average is a little less than $12 million.

As for the funding raised, the largest round invested in a woman-led startup was $165 million, whereas $3 billion was invested in a male-led company.

Why do women gain less money than men when raising funds?

One of the reasons may be that venture capitalists hold gender bias.

Venture Capitalists’ Double Standard

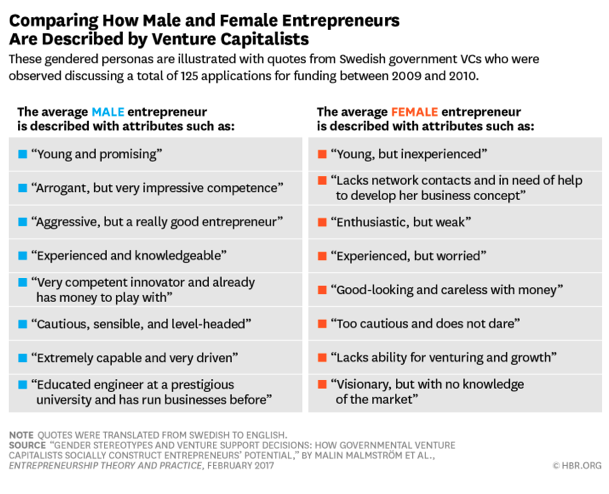

Venture capitalists often retain a double standard between men and women.

If women are direct, they are often accused of being “pushy.” However, if a man is direct, he is generally considered confident and assertive.

As reported by the article “The Words VCs Use for Male vs. Female Founders — and how to Fight Bias in Startup Funding”, when investors talked about a male entrepreneur who owned an expensive car, they said he was a financially well-off person who knows how to do business because he has the extra money to spend on toys. But when a woman had an expensive car, they instead said that she was careless with money.

Such examples are numerous. Careful men are thought of as cautious, sensible and level-headed while careful women are too cautious and timid. Young male entrepreneurs are labeled “promising” while young female entrepreneurs are dismissed as “inexperienced.”

Additionally, having children has different effects on men and women. Being a father is considered an asset for a man. In contrast, being a mother is often taken to mean the woman is not capable of holding down a career.

Pregnancy Freaks Investors Out

What’s more appalling is once female entrepreneurs get pregnant, they are less likely to get funding.

Pregnancy discourages venture capitalists because of the notion that pregnant women spend more time taking care of children and themselves instead of making profits.

According to the article called “How Ingrained Is Sexism in Silicon Valley? Ask the Women Trying to Get Funding,” an interviewee who is a co-founder of a former health-care start-up said once it was very clear that she was pregnant, the conversations with venture capitalists were all about her pregnancy, such as “Are you taking time off? I know my wife had a difficult time getting back to the workplace.”

Another interviewee asserted that she was told that investors never invest in a pregnant woman. Her worst experience was when an investor asked her how much maternity leave she was taking. Her answer was one week. The investor answered “I guess you’re not going to be a very good mother, then.” But if she planned to take more time off, she would be judged as a terrible leader.

Different Questions for Men and Women

A study presented in the Havard Business Review has demonstrated how gender stereotypes about the competence and ability of women may bias how others assess the business plans of female entrepreneurs, which may discourage women from pursuing entrepreneurship and make it more difficult for them to obtain funding and support.

Venture capitalists ask questions also reflecting the gender bias. Venture capitalists posed different questions to male and female entrepreneurs: they tended to ask men about the potential for gains, which is promotion-oriented, and ask women about the potential for losses, which is prevention-oriented.

For example, investors are more likely to ask men how they plan to acquire customers but ask women what strategies they use to keep customers. In most cases, entrepreneurs’ answers match the orientations of each question. Investors don’t like prevention-oriented answers. Thus, female entrepreneurs who give prevention-oriented answers are less likely to receive funds.

Even though gender equality is already a goal the whole society tries to achieve, there is still a long way to go. However, there is not only gender bias that explains the large funding gap between male and female entrepreneurs. Other reasons exist. For example, we have fewer female founders who sign up on our platform ideasvoice.com to showcase their projects. Despite the fact that IdeasVoice welcomes all female entrepreneurs who try to find cofounders, investments, and resources, less than 20% of the projects are founded by women, and this is before one even begins looking for investors. Hopefully, in the future, there will be more female entrepreneurs, and access to VCs will be easier for them.

By Xinlan Yu of IdeasVoice US

Related articles :

Gender Status Beliefs in Entrepreneurship and Innovation: Are Women Entrepreneurs Penalized

Unequal Hard Times: The Influence of the Great Recession on Gender Bias in Entrepreneurial Financing